mirror of

https://github.com/verymeticulous/wikAPEdia.git

synced 2025-06-13 13:07:56 -05:00

Compare commits

53 Commits

| Author | SHA1 | Date | |

|---|---|---|---|

| 66563518d6 | |||

| 6608c25f6c | |||

| 12743ed8ef | |||

| 3616a378b0 | |||

| 31f2f4615a | |||

| 9ce353a159 | |||

| 14a35ba37c | |||

| c2561a0452 | |||

| af52a7896f | |||

| c5befebe08 | |||

| b0ba6614cd | |||

| 0f315ff64e | |||

| 8e717d4841 | |||

| 40bec0d897 | |||

| 28837a228f | |||

| e219806da2 | |||

| 67f87a6f6a | |||

| 3df2051e38 | |||

| c29b2f7994 | |||

| 15af9ac1ef | |||

| 5d0cfa9c76 | |||

| 2f03adfc8a | |||

| 6db9b3d022 | |||

| fb9097cb5e | |||

| 4b15318ae5 | |||

| 78ba1879d7 | |||

| 22ff8824cb | |||

| 2d05aa77ae | |||

| 490bdd08a8 | |||

| 704ca2c5e8 | |||

| 1a04abdd5f | |||

| 74677fb260 | |||

| 61e39b9ea4 | |||

| d54d12853c | |||

| a1d6834e6d | |||

| 495f04e235 | |||

| 423380c407 | |||

| 1f4ee24de4 | |||

| 7176db33f1 | |||

| ea719b18ff | |||

| f1ea7401e5 | |||

| 57e7274f6b | |||

| 991687cc6d | |||

| f42416d5af | |||

| 59cf0cceb3 | |||

| 1d0fee063a | |||

| 6a962c7fb5 | |||

| 3cf39bf7af | |||

| 6ba35fd75b | |||

| e5d81b6992 | |||

| 3d1880165a | |||

| 1294bf410e | |||

| f1d9a1997e |

@ -0,0 +1,74 @@

|

|||||||

|

GME is not a Random Anomaly | Why my nerdy math tits are jacked that Renaissance Technologies have gone long on GME

|

||||||

|

===================================================================================================================

|

||||||

|

|

||||||

|

| Author | Source |

|

||||||

|

| :-------------: |:-------------:|

|

||||||

|

| [u/jsmar18](https://www.reddit.com/user/jsmar18/) | [Reddit](https://www.reddit.com/r/Superstonk/comments/p85xbm/gme_is_not_a_random_anomaly_why_my_nerdy_math/) |

|

||||||

|

|

||||||

|

---

|

||||||

|

|

||||||

|

[Opinion 👽](https://www.reddit.com/r/Superstonk/search?q=flair_name%3A%22Opinion%20%F0%9F%91%BD%22&restrict_sr=1)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/42ywv8b5pii71.png?width=944&format=png&auto=webp&s=39b0382b77639d37cddc21808a7bf4d42355fa84)

|

||||||

|

|

||||||

|

https://whalewisdom.com/stock/gme

|

||||||

|

|

||||||

|

Why am I excited about this?

|

||||||

|

|

||||||

|

A few people have already posted about it, but me being a math nerd, this makes me particularly excited and I'll explain why, although - with most of my posts, you're gonna get a history lesson, so get those crayons out and get ready to either snort them or write notes!

|

||||||

|

|

||||||

|

Treating the Stock Market as a Casino

|

||||||

|

|

||||||

|

This is true for Renaissance Technologies (Ren Tech) in the truest sense. A casino always has an edge over its players.

|

||||||

|

|

||||||

|

Take a slot machine for example:

|

||||||

|

|

||||||

|

A return to player is at an average of ~96%, this means if you walk in with $100, after a large number of spins, you'll be drained to $0 due to the 4% edge the casino has over you. In the long run, the casino will always win - also known as the law of large numbers, the average of the results obtained from a large number of trials (or spins in the case above), should be close to the expected value (the return to player of 96%).

|

||||||

|

|

||||||

|

The Medallion Fund

|

||||||

|

|

||||||

|

This particular fund, which is their most famous and profitable, beginning in 1988, after a rocky start, they hired a professor named [Elwyn Berlekamp](https://en.wikipedia.org/wiki/Elwyn_Berlekamp) which is where their returns started taking a turn for the better, consistently outperforming the market.

|

||||||

|

|

||||||

|

An average return of 71.8% annual return before fees from 1994 to mid-2014. Insane.

|

||||||

|

|

||||||

|

[](https://preview.redd.it/l5xx5pebpii71.png?width=898&format=png&auto=webp&s=64e24a6fa19095b94f7950af259d93604f2ef076)

|

||||||

|

|

||||||

|

Elwyn pretty much set the stone for Ren Tech's success, he rewrote their trading algos to focus on short-term trade with sizing based on the opportunity.

|

||||||

|

|

||||||

|

A Scientific Gambling Method

|

||||||

|

|

||||||

|

From this anecdotal talk about how Elwyn approached trading algorithms lies the comparison to our casino, but in the world of science instead. The Kelly Criterion. Which is a formula that helps determine the optimal theoretical size for a bet. It's commonly used with investment decisions, and if you have an edge on the casino, take advantage of it while optimizing your asset allocation! As Bob Mercer said, who was also employed at Ren Tech:

|

||||||

|

|

||||||

|

> We're right 50.75% of the time... but we're 100% right 50.75% of the time. You can make billions that way.

|

||||||

|

|

||||||

|

The % referenced here was their ability to correctly predict the direction of medium/short term trades 50.75% of the time. Mercer and his colleagues built a system that modeled the relationship between stocks and then used this information to predict future bias in their price movement.

|

||||||

|

|

||||||

|

Back to the Main Story

|

||||||

|

|

||||||

|

Ren Tech has entered into a position with GME, owning it at some point in Q2 2021 and still likely owning in Q3 given that by 30th June 2021, we passed the initial June peak and were back down to the ~$213 mark.

|

||||||

|

|

||||||

|

I'm going to suggest they bought after the June run-up and subsequent run-down and I'll explain why.

|

||||||

|

|

||||||

|

Back in 2015, old mate Jim Simons, the founder of Ren Tech was on a [TED Talk](https://www.youtube.com/watch?v=lji-jNsXmAM&t=552s) - I remember watching this video in the early days of GME, because hey, learn from the best, right?

|

||||||

|

|

||||||

|

GME is an Anomaly

|

||||||

|

|

||||||

|

Jim said in the Ted Talk:

|

||||||

|

|

||||||

|

> An anomaly might be a random thing, but given enough data you can tell it's not. You can see an anomaly that's persistent for a sufficiently long enough time, so that the probability of it being random is not high. But these things fade after a while, anomalies get washed out, so you gotta keep on top of those.

|

||||||

|

|

||||||

|

This was in 2015, so it does have some recency issues (left Ren Tech in 2009). However, him mentioning that jacks my tits. He was the first one to start using pattern analysis and ML when it came to trading commodities in the early days. The dude was an avid user of mean reversion as well, bringing it into popularity - and then the industry caught up, and then he hired lots of ultra-wrinkle brains to push the limits of mathematics and information theory further.

|

||||||

|

|

||||||

|

The main point I'm trying to make here and above is, they are GREAT at picking stocks that'll make them money and it's all based on the data.

|

||||||

|

|

||||||

|

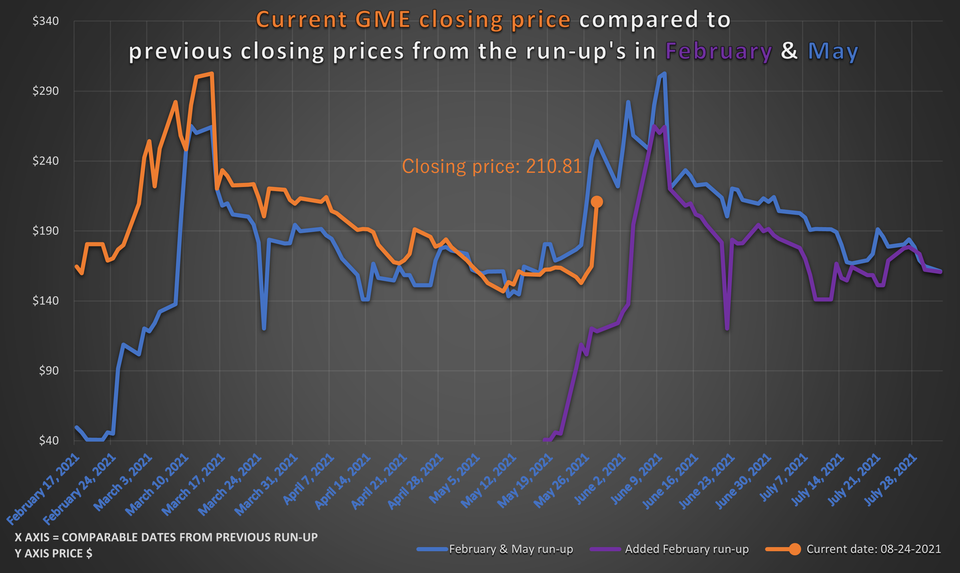

[](https://preview.redd.it/t7nhqz2ipii71.png?width=933&format=png&auto=webp&s=a0a5cdc50e3923a20de9c4b82445132ebcf6bdf2)

|

||||||

|

|

||||||

|

Thanks u/Broccaa for making this particular image and the Pomeraniape u/Criand for discovering it 🙏

|

||||||

|

|

||||||

|

Speculation Warning 🚀🚀🚀🚀

|

||||||

|

|

||||||

|

This brings me to what [u/Criand](https://www.reddit.com/u/Criand/) has been speculating. I feel in my gut it's correct, and given the information above, I also think Ren Tech has figured out something similar as well (although given vast amounts more data than we could ever dream of getting our hands-on).

|

||||||

|

|

||||||

|

To Ren Tech, the rollover period in Feb/March, where we saw the first spike after the Jan sneeze was a random anomaly, come the June spike and rollover period, I think that random anomaly turned into a not-so-random anomaly for them. So that leads me to my speculation that they bought after the June run-up when this random anomaly became a genuine market anomaly that they wanted to get a piece of the action.

|

||||||

|

|

||||||

|

Thank you for coming to my TED Talk. See you soon with some fun SEC market structure analysis.

|

||||||

@ -0,0 +1,34 @@

|

|||||||

|

FOUND CONNECTION BETWEEN TODAYS MOVEMENT AND BRAZIL PUTS

|

||||||

|

========================================================

|

||||||

|

|

||||||

|

| Author | Source |

|

||||||

|

| :-------------: |:-------------:|

|

||||||

|

| [u/bolonga16](https://www.reddit.com/user/bolonga16/) | [Reddit](https://www.reddit.com/r/Superstonk/comments/pauf6x/found_connection_between_todays_movement_and/) |

|

||||||

|

|

||||||

|

---

|

||||||

|

|

||||||

|

[Discussion 🦍](https://www.reddit.com/r/Superstonk/search?q=flair_name%3A%22Discussion%20%F0%9F%A6%8D%22&restrict_sr=1)

|

||||||

|

|

||||||

|

I was watching the order list today as price was moving and i noticed block orders from an exchange EDGX were pouring in thousands at a time. I took this screencap later so at the time there weren't as many, Imagine that 2k block order but filling half the feed

|

||||||

|

|

||||||

|

<https://preview.redd.it/64uw776jcdj71.png?width=1314&format=png&auto=webp&s=2f3fea9861c1d0496c6eb914a7e6c21eb35a6bfb>

|

||||||

|

|

||||||

|

It peaked my interest, so I did some digging on trusty Wiki

|

||||||

|

|

||||||

|

<https://preview.redd.it/xyphk05kxcj71.png?width=1567&format=png&auto=webp&s=4156be7b3b90217fcc51fbda56d8b374eab67b52>

|

||||||

|

|

||||||

|

Anything stick out to you? Last two companies to take ownership of said exchange are.....CITADEL AND GOLDMAN SACKS. Not only that but the Exchange is operated in.......... Rio de Janeiro, Brazil!

|

||||||

|

|

||||||

|

Coincidence?

|

||||||

|

|

||||||

|

Y'all tell me.

|

||||||

|

|

||||||

|

Edit: If this holds up, it means AT LEAST Bloomberg is colluding with Citadel. Their excuse about the "bug" should be held against them.

|

||||||

|

|

||||||

|

Edit 2: Prior to his career in the federal government, Gensler worked at Goldman Sachs, where he was a partner and co-head of finance.

|

||||||

|

|

||||||

|

---

|

||||||

|

|

||||||

|

**Relevant Comment by [u/wesg2](https://www.reddit.com/user/wesg2/)**

|

||||||

|

|

||||||

|

The [Brazilian requirements](https://www.reddit.com/r/DDintoGME/comments/parhth/are_shfs_trying_to_get_around_the_isda_phase_5/) for ISDA's Phase 5 reporting are NOT the same as the U.S. requirements. Brazil had 1 transaction we saw from Citadel at an [undisclosed dollar value](https://www.reddit.com/r/Superstonk/comments/otzu3e/posting_some_more_info_to_help_wrinkle_brains/). They might be unloading enough to get below the reporting threshold for 2021. That's what's been bugging me all day.

|

||||||

@ -0,0 +1,194 @@

|

|||||||

|

The Daily Stonk Aug 16, 2021

|

||||||

|

============================

|

||||||

|

|

||||||

|

| Author | Source |

|

||||||

|

| :-------------: |:-------------:|

|

||||||

|

| [u/Blazlyn](https://www.reddit.com/user/Blazlyn/) | [Reddit](https://www.reddit.com/r/Superstonk/comments/p5dni2/the_daily_stonk_aug_16_2021/) |

|

||||||

|

|

||||||

|

---

|

||||||

|

|

||||||

|

[HODL 💎🙌](https://www.reddit.com/r/Superstonk/search?q=flair_name%3A%22HODL%20%F0%9F%92%8E%F0%9F%99%8C%22&restrict_sr=1)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/amg3p9473ph71.png?width=1600&format=png&auto=webp&s=000473c6597551d61f364c3138a2f092355884ef)

|

||||||

|

|

||||||

|

[Gooooooood Moooooorning Superstonk!](https://www.youtube.com/watch?v=AwSra5p8MDw)

|

||||||

|

|

||||||

|

It is a wonderful day to be up and in the jungle!

|

||||||

|

|

||||||

|

[](https://preview.redd.it/nz3aozs55ph71.jpg?width=640&format=pjpg&auto=webp&s=b3213d198726f6a27732854c27194de6e0ffe0db)

|

||||||

|

|

||||||

|

[u/sugardevil27](https://www.reddit.com/u/sugardevil27/)

|

||||||

|

|

||||||

|

A lot of Memes and big news! You know what that means! Do 5 push ups and call it 150 because were about to look at our favorite rehypothication stock!

|

||||||

|

|

||||||

|

[Reverse Repo seems to be cruising above $1T!](https://www.reddit.com/r/Superstonk/comments/p3pmu1/daily_reverse_repo_update_0813_1050941b/)

|

||||||

|

|

||||||

|

Maintaining the cruising altitude with a sleight $50m dollar bump to make sure that we are out of the way of other air traffic.

|

||||||

|

|

||||||

|

In the event my goldfish brain forget here is [Reverse Repo explained](https://www.reddit.com/r/Superstonk/comments/owwk1p/the_rrp_number_is_incredible_but_what_does_it/h7iv86i/?context=3) in a way even I can understand.

|

||||||

|

|

||||||

|

[](https://preview.redd.it/irhmf3483ph71.png?width=700&format=png&auto=webp&s=57186ab8c19a3738f9c98b0b81b8c74d0d69ac99)

|

||||||

|

|

||||||

|

[Treasury is at $351B](https://www.reddit.com/r/Superstonk/comments/p3t1p1/daily_treasury_balance_for_0812_351b_38b/?ref=share&ref_source=link)

|

||||||

|

|

||||||

|

Looks like a drop of $38B.

|

||||||

|

|

||||||

|

[](https://preview.redd.it/jdcjw8pm3ph71.png?width=960&format=png&auto=webp&s=3bb2fe836202521ea354386ef93a89914a35ea71)

|

||||||

|

|

||||||

|

[Low Volume of 1.004 Million](https://finance.yahoo.com/quote/GME/?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAHq6Tq_IvJ7rsEd5p9bX46_FSdCDIAH4khGld5Hpu3kigzzepd0Z448Fntj0CShiYBNzlxMUTobwHdUslLIUlY5u7Zp-TtfxTeVYWWKEM7YwkduVyMw3IdDtEhTpY4uSCwm9kNaHLNEVONTruW_7OTZ89VcBXmPPTOtHQg75MS8b)

|

||||||

|

|

||||||

|

I hope [u/edgar510](https://www.reddit.com/u/edgar510/) enjoyed his weekend! Because I look forward to whatever graphic he posts today!

|

||||||

|

|

||||||

|

[Route Through IEX](https://www.youtube.com/watch?v=SLNySV4OQfk)

|

||||||

|

|

||||||

|

Seriously. Do it.

|

||||||

|

|

||||||

|

[US Inflation Chart](https://www.reddit.com/r/Superstonk/comments/p51rh5/exactly_50_years_ago_today_aug_151971_the_us_was/?utm_medium=android_app&utm_source=share)

|

||||||

|

|

||||||

|

This is a great graphic showing the loss of buying power and how liuttle we can buy today vs the dollars inception and subsequent hits via things like illegal to own gold and the removal from the gold standard.

|

||||||

|

|

||||||

|

[](https://preview.redd.it/cqxw67od4ph71.png?width=960&format=png&auto=webp&s=6cbec76a40b2f105db292a69af0251e4df55fcb5)

|

||||||

|

|

||||||

|

[Computer Share and Wells Fargo?](https://www.reddit.com/r/Superstonk/comments/p5d38p/need_more_eyes_on_this_computershare_entered_a/?utm_medium=android_app&utm_source=share)

|

||||||

|

|

||||||

|

Usually I stick to a day out to let news develop but with how much "ComputerShare" came and vanished I was skeptical of even including it. Now apparently they are filing to acquire Wells Fargo corporate trust. Some wrikle brains have some words for a smooth brain like me to explain what this all means? Is computer share trustworthy? Is this the beginning of the "small fry participants" starting to get burned?

|

||||||

|

|

||||||

|

[Market Crash? Buckle Up!](https://www.reddit.com/r/Superstonk/comments/p50i5k/impending_market_crash_and_gme_moass/?utm_medium=android_app&utm_source=share)

|

||||||

|

|

||||||

|

A good quick write up with a bunch of good comparison graphics. Got to the post to look at the pictures because there are a lot of them. Just remember TA provides a reference and not a formula.

|

||||||

|

|

||||||

|

[Looks Like We Are Primed to Rise!](https://www.reddit.com/r/Superstonk/comments/p4wpd5/buckle_up/?utm_medium=android_app&utm_source=share)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/p5kzknc47ph71.jpg?width=640&format=pjpg&auto=webp&s=9adb5bb2b85464c52d95e05543152c2ac3866ed8)

|

||||||

|

|

||||||

|

[TA For Boom?](https://www.reddit.com/r/Superstonk/comments/p4bra4/gme_is_about_to_blow/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/nys00c8k9ph71.png?width=960&format=png&auto=webp&s=455b591ff6d1737727c315b3b56123187100ec99)

|

||||||

|

|

||||||

|

[Cayman Islands Are a Sore Spot So They Stay](https://www.reddit.com/r/Superstonk/comments/p2aeyi/sorry_apes_apparently_im_facilitating_illegal/?ref=share&ref_source=link)

|

||||||

|

|

||||||

|

Dig dig diggity dig! Below you can see the location of [40,000 companies](https://www.reddit.com/r/Superstonk/comments/p3c70y/nothing_too_important_but_this_is_the_building_in/). Kind of amazing that they all fit there! [PoDDible information of the boys club that is hiding there!](https://www.reddit.com/r/Superstonk/comments/p3a79x/billionaire_boys_club_bbc_ep_102_cayman_island/)

|

||||||

|

|

||||||

|

[Some Solid DD About Secret Sauce](https://www.reddit.com/r/Superstonk/comments/p37osl/are_futures_or_swaps_the_secret_sauce_to_price/)

|

||||||

|

|

||||||

|

It is crime. [u/Criand](https://www.reddit.com/u/Criand/) elaborates.

|

||||||

|

|

||||||

|

[I Wish I Made $0.77 per $0.23 Spent](https://www.reddit.com/r/Superstonk/comments/p4xsxs/theyve_been_cheating_the_system_for_years_which/?utm_medium=android_app&utm_source=share)

|

||||||

|

|

||||||

|

Oh wait. My cut and the government's cut will be better than that. BUY and HODL.

|

||||||

|

|

||||||

|

[](https://preview.redd.it/v1crpser7ph71.png?width=583&format=png&auto=webp&s=1d7649dcffff97c7f1ac7fb3ea664633d422f07d)

|

||||||

|

|

||||||

|

[Looks Like OTC Increased... For January.](https://www.reddit.com/r/Superstonk/comments/p4w9hq/january_gme_otc_trades_increased_by_32_last_week/?utm_medium=android_app&utm_source=share)

|

||||||

|

|

||||||

|

Really? How is this even allowed to happen. If I turned in my rent check 6 months later I would have been homeless for 4 of those months. [u/Derealizationed](https://www.reddit.com/u/Derealizationed/) has been tracking some numbers and [this may be another piece of his puzzle.](https://www.reddit.com/r/Superstonk/comments/ov9vc2/gme_market_cap_almost_9_billion_dollars_higher_in/?utm_source=share&utm_medium=ios_app&utm_name=iossmf) I look forward to whatever DD comes from this. Tick Tock Vladdy Boi.

|

||||||

|

|

||||||

|

[Zacks Rates GME as HODL](https://www.reddit.com/r/Superstonk/comments/p4c3hm/gme_is_projected_to_report_earnings_of_042_per/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/ion8mp1o8ph71.jpg?width=960&format=pjpg&auto=webp&s=3a99750272fe37b12707ea8e3d022e969f6b9aff)

|

||||||

|

|

||||||

|

[Marge N Gets a New Phone in September](https://www.reddit.com/r/Superstonk/comments/p44h5o/dtcc_executive_director_warns_that_due_to_changes/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/19sxanyt8ph71.jpg?width=640&format=pjpg&auto=webp&s=99339e6e1238b70b69659ade4b366a767f13616e)

|

||||||

|

|

||||||

|

Memes:

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p3m00s/ricks_big_bet/?utm_medium=android_app&utm_source=share>

|

||||||

|

|

||||||

|

[](https://preview.redd.it/n02eqx424ph71.png?width=960&format=png&auto=webp&s=09ddcf8735e9b829d452c9c80d44aba04ec81d0e)

|

||||||

|

|

||||||

|

[u/Sassqueachy](https://www.reddit.com/u/Sassqueachy/)

|

||||||

|

|

||||||

|

[u/Gandofu8](https://www.reddit.com/u/Gandofu8/) giving us awkward boners....

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p50r3k/every_time_you_reach_out_for_something_you_care/?utm_medium=android_app&utm_source=share>

|

||||||

|

|

||||||

|

[](https://preview.redd.it/wuglfn9j4ph71.jpg?width=750&format=pjpg&auto=webp&s=89b4ea1c78d9a0e75a54ee606b824a6455ea61b2)

|

||||||

|

|

||||||

|

[u/Diamond-Solo](https://www.reddit.com/u/Diamond-Solo/)

|

||||||

|

|

||||||

|

[u/Bye_Triangle](https://www.reddit.com/u/Bye_Triangle/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/vn5t45zn4ph71.png?width=640&format=png&auto=webp&s=fee5d6a14b3e28d30241a88aca8965f627e42738)

|

||||||

|

|

||||||

|

Seriously though... Why whale teeth?

|

||||||

|

|

||||||

|

[](https://preview.redd.it/qw2rgs6t4ph71.jpg?width=960&format=pjpg&auto=webp&s=70736dc3d760182970676bcb94644b7b8aef600f)

|

||||||

|

|

||||||

|

[u/infj-t](https://www.reddit.com/u/infj-t/)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p4xggv/i_hate_my_job/?utm_medium=android_app&utm_source=share>

|

||||||

|

|

||||||

|

[u/joeygallinal](https://www.reddit.com/u/joeygallinal/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/4kz24j8z4ph71.jpg?width=960&format=pjpg&auto=webp&s=9d3d138a11c693ee54e034280eee05f0975d2763)

|

||||||

|

|

||||||

|

Stephen is a national treasure

|

||||||

|

|

||||||

|

[u/towelfine6933](https://www.reddit.com/u/towelfine6933/)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p4qkep/my_retirement_journey_in_three_stepsnot_finicial/>

|

||||||

|

|

||||||

|

[u/Fit-Tacle-6107](https://www.reddit.com/u/Fit-Tacle-6107/)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p3adl0/all_aboard/?utm_medium=android_app&utm_source=share>

|

||||||

|

|

||||||

|

[u/JNO50593](https://www.reddit.com/u/JNO50593/)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p3l7z5/how_many_new_rules_have_been_introduced_this_year/?utm_medium=android_app&utm_source=share>

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p333xw/lets_hear_it_for_bryan_cohen/>

|

||||||

|

|

||||||

|

[u/DucksAndPills](https://www.reddit.com/u/DucksAndPills/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/2k6rl8of5ph71.jpg?width=500&format=pjpg&auto=webp&s=79d5bdf0bfff05db747808b8bd2f7cd7f83296fd)

|

||||||

|

|

||||||

|

[u/keenfreed](https://www.reddit.com/u/keenfreed/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/0ym2rqoy8ph71.jpg?width=1080&format=pjpg&auto=webp&s=569a37eb8a6667cc72eda0b132922039af4ef527)

|

||||||

|

|

||||||

|

GME BULLISH

|

||||||

|

|

||||||

|

[u/nickzastro](https://www.reddit.com/u/nickzastro/)

|

||||||

|

|

||||||

|

AMA: You Asked, Mods Listened!

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p2ttdo/ama_announcement_robert_shapiro_lucy_komisar_18th/>

|

||||||

|

|

||||||

|

[EXCELLENT!](https://giphy.com/gifs/ifc-80s-bill-and-ted-excellet-l46CDHTqbmnGZyxKo)

|

||||||

|

|

||||||

|

We don't care, just be nice and let's make this community as Excellent as we can!

|

||||||

|

|

||||||

|

A few wrinkled-brained apes for quick post history access:

|

||||||

|

|

||||||

|

[u/DeepFuckingValue](https://www.reddit.com/u/DeepFuckingValue/) (dont need to explain)

|

||||||

|

|

||||||

|

[u/atobitt](https://www.reddit.com/u/atobitt/) (DD)

|

||||||

|

|

||||||

|

[u/Criand](https://www.reddit.com/u/Criand/) (DD)

|

||||||

|

|

||||||

|

[u/peruvian_bull](https://www.reddit.com/u/peruvian_bull/) (DD addict)

|

||||||

|

|

||||||

|

[u/Parsnip](https://www.reddit.com/u/Parsnip/) (German Market Guy | Diamantenhände)

|

||||||

|

|

||||||

|

[u/DR7KE](https://www.reddit.com/u/DR7KE/) (scales Treasury Balance Guy scales)

|

||||||

|

|

||||||

|

[u/pctracer](https://www.reddit.com/u/pctracer/) (Reverse Repo Market Updater)

|

||||||

|

|

||||||

|

[u/JTH1](https://www.reddit.com/u/JTH1/) (Floor Guy Stonkdate)

|

||||||

|

|

||||||

|

[u/mr_boost](https://www.reddit.com/u/mr_boost/) (Ape News Network | Sign Guy)

|

||||||

|

|

||||||

|

[u/gherkinit](https://www.reddit.com/u/gherkinit/) (Daily Technical Analysis)

|

||||||

|

|

||||||

|

[u/Dismal-Jellyfish](https://www.reddit.com/u/Dismal-Jellyfish/)

|

||||||

|

|

||||||

|

Thank you to the mod team!! Thank you to YOU ALL BEAUTIFUL APES!

|

||||||

|

|

||||||

|

Remember not to to give your password or log in information to anyone. If it seems suspicious don't do it! Phishing attacks have become more common across all platforms.

|

||||||

|

|

||||||

|

As always we are here from all different walks of life and all different countries. This doesn't matter as we are all apes in here, and apes are friends. We help each other, we care for each other. Ape don't fight ape, apes help other apes!

|

||||||

|

|

||||||

|

Remember the fundamentals of this company are great, so for the love of god if someone starts with trying to spread FUD, remind yourself of the fundamentals. BUY and HODL.

|

||||||

|

|

||||||

|

Okay that is all for now smell ya later!

|

||||||

@ -0,0 +1,158 @@

|

|||||||

|

The Daily Stonk Aug 17, 2021

|

||||||

|

============================

|

||||||

|

|

||||||

|

| Author | Source |

|

||||||

|

| :-------------: |:-------------:|

|

||||||

|

| [u/Blazlyn](https://www.reddit.com/user/Blazlyn/) | [Reddit](https://www.reddit.com/r/Superstonk/comments/p61aoa/the_daily_stonk_aug_17_2021/) |

|

||||||

|

|

||||||

|

---

|

||||||

|

|

||||||

|

[HODL 💎🙌](https://www.reddit.com/r/Superstonk/search?q=flair_name%3A%22HODL%20%F0%9F%92%8E%F0%9F%99%8C%22&restrict_sr=1)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/48dvkk2o9wh71.png?width=1600&format=png&auto=webp&s=32349efdf80f1e6f10458e6dacc1b99e039d30b1)

|

||||||

|

|

||||||

|

[Gooooooood Moooooorning Superstonk!](https://www.youtube.com/watch?v=AwSra5p8MDw)

|

||||||

|

|

||||||

|

It is a wonderful day to be up and in the jungle!

|

||||||

|

|

||||||

|

Yesterday wasn't nearly as exciting as this weekend. Let's get into it! 3 sets of 5 Pull Ups. If you can't do that do one and rehypothicate the rest!

|

||||||

|

|

||||||

|

[u/caulk-snorter](https://www.reddit.com/u/caulk-snorter/) WE ARE PROUD OF YOUR [11 DAY SOBRIETY!!!](https://www.reddit.com/r/Superstonk/comments/p5x2uf/i_am_now_11_days_sober_from_alcohol_first_time_in/)

|

||||||

|

|

||||||

|

[Reverse Repo is Standing There MENACINGLY at $1T!](https://www.reddit.com/r/Superstonk/comments/p5km44/daily_reverse_repo_update_0816_1036418b/)

|

||||||

|

|

||||||

|

Still just sitting there....

|

||||||

|

|

||||||

|

In the event my goldfish brain forget here is [Reverse Repo explained](https://www.reddit.com/r/Superstonk/comments/owwk1p/the_rrp_number_is_incredible_but_what_does_it/h7iv86i/?context=3) in a way even I can understand.

|

||||||

|

|

||||||

|

[](https://preview.redd.it/8lqbhgkw9wh71.png?width=700&format=png&auto=webp&s=7a5ace7ad4a66b7ecd49e1147a0289800b405648)

|

||||||

|

|

||||||

|

[Treasury is at $335B](https://www.reddit.com/r/Superstonk/comments/p5nurq/daily_treasury_balance_for_0813_335b_16b/)

|

||||||

|

|

||||||

|

A nice drop of $16B.

|

||||||

|

|

||||||

|

[](https://preview.redd.it/fddrbr2dawh71.png?width=960&format=png&auto=webp&s=037c0992050fa58e91523bc2f6cb42579f9ed5f9)

|

||||||

|

|

||||||

|

[Tick tock on the way to $0](https://www.reddit.com/r/Superstonk/comments/p5potn/treasury_balance_prediction_new_linear_bankruptcy/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/9prk0bzubwh71.png?width=960&format=png&auto=webp&s=3fb5b34f7fbdc8742307a5a41a188c259f6258e2)

|

||||||

|

|

||||||

|

[Low Volume of 1.55 Million](https://www.reddit.com/r/Superstonk/comments/p5ofy6/i_cant_hear_you_version_20_closed_with_155_mil/)

|

||||||

|

|

||||||

|

[u/edgar510](https://www.reddit.com/u/edgar510/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/zetyz0lcawh71.jpg?width=821&format=pjpg&auto=webp&s=481a094f07907eb90cf9f39577c275bf21ef2928)

|

||||||

|

|

||||||

|

[Route Through IEX](https://www.youtube.com/watch?v=SLNySV4OQfk)

|

||||||

|

|

||||||

|

Seriously. Do it.

|

||||||

|

|

||||||

|

[NYSE Securities List is The Streissand Effect Incarnate](https://www.reddit.com/r/Superstonk/comments/p5u6g5/shfs_and_mms_are_coordinating_to_keep_gme_from/)

|

||||||

|

|

||||||

|

" HFs & short-sellers have been carefully coordinating FTDs to prevent GME from returning to the threshold security list. This is because even bona-fide market makers must deliver shares for threshold securities, and as long as GME is not on this list, bona-fide market makers can avoid closing out FTDs."

|

||||||

|

|

||||||

|

[u/plants69](https://www.reddit.com/u/plants69/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/swyh942qawh71.png?width=1647&format=png&auto=webp&s=a256c17dfc822a3976e10fb4cea57807b52d28c6)

|

||||||

|

|

||||||

|

[Is it Audit Time for The DTCC?](https://www.reddit.com/r/Superstonk/comments/p5uwv6/was_doing_some_reading_on_bernie_madoff_the/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/whzbq7swawh71.png?width=960&format=png&auto=webp&s=5687195e59dd2c5df8fce13b6801e1201184dbc6)

|

||||||

|

|

||||||

|

[Market Crash? Buckle Up!](https://www.reddit.com/r/Superstonk/comments/p50i5k/impending_market_crash_and_gme_moass/?utm_medium=android_app&utm_source=share)

|

||||||

|

|

||||||

|

A good quick write up with a bunch of good comparison graphics. Got to the post to look at the pictures because there are a lot of them. Just remember TA provides a reference and not a formula.

|

||||||

|

|

||||||

|

[When in Doubt Zoom WAAAAAYYYYYY Out](https://www.reddit.com/r/Superstonk/comments/p5rlsj/just_up_we_are_finally_reconnecting_with_a_trend/)

|

||||||

|

|

||||||

|

Looks like we reconnected with a long lost floor. [Floor Guy?](https://www.youtube.com/watch?v=DnfSoaJxe3Y)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/e0rp45ppbwh71.jpg?width=960&format=pjpg&auto=webp&s=cefeb0dac89de4605a1d2850b72be58e12f71810)

|

||||||

|

|

||||||

|

[Kenny Got Mad We Saw Him Fly](https://www.reddit.com/r/Superstonk/comments/p5og81/i_guess_ken_saw_those_posts/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/r624kq6abwh71.jpg?width=640&format=pjpg&auto=webp&s=95cd3b561eda04c29bb121c964d5123f47f1ba5b)

|

||||||

|

|

||||||

|

[Looks Like Citadel Is On Its Way Down](https://www.reddit.com/r/Superstonk/comments/p5liqm/remember_citadel_working_late_into_the_night_with/)

|

||||||

|

|

||||||

|

Mad employees don't stay with a company. High levels of turnover aren't good for a company. Looks like something is bleeding and "I won't be the on on the chopping block" is starting to come crashing down. Remember interns and entry level people reading this: [YOU CAN MAKE MILLIONS TO REPORT THINGS TO THE SEC.](https://www.sec.gov/news/press-release/2021-128)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/iqqyx2eecwh71.png?width=744&format=png&auto=webp&s=c534e9e1d407e81a82709000731eb2af69c7d373)

|

||||||

|

|

||||||

|

[Cayman Islands Are a Sore Spot So They Stay](https://www.reddit.com/r/Superstonk/comments/p2aeyi/sorry_apes_apparently_im_facilitating_illegal/?ref=share&ref_source=link)

|

||||||

|

|

||||||

|

Dig dig diggity dig! Below you can see the location of [40,000 companies](https://www.reddit.com/r/Superstonk/comments/p3c70y/nothing_too_important_but_this_is_the_building_in/). Kind of amazing that they all fit there! [PoDDible information of the boys club that is hiding there!](https://www.reddit.com/r/Superstonk/comments/p3a79x/billionaire_boys_club_bbc_ep_102_cayman_island/)

|

||||||

|

|

||||||

|

[Somehow BUY and HODL Breaking The Market Is "Reddit's Fault"](https://www.reddit.com/r/Superstonk/comments/p5k1lw/robinhood_other_brokers_would_have_defaulted/)

|

||||||

|

|

||||||

|

Give it a watch. The logic is astounding....

|

||||||

|

|

||||||

|

[Looks Like The SEC Can Explore The World](https://www.reddit.com/r/Superstonk/comments/p5gqw8/sec_alert_us_securities_and_exchange_commission/)

|

||||||

|

|

||||||

|

SEC can now work with EU partnerships for investigations. International Adventure Awaits!

|

||||||

|

|

||||||

|

[Tax Changes! Retroactive To April 2021](https://www.reddit.com/r/Superstonk/comments/p5hr5d/the_new_tax_proposal_is_prepared_for_moass/)

|

||||||

|

|

||||||

|

Gotta make sure they get all the sweet gains from retail that they have been missing out on from the top.... That is if it happens before Jan 2022. Tick TOCK.

|

||||||

|

|

||||||

|

[Zacks Rates GME as HODL](https://www.reddit.com/r/Superstonk/comments/p4c3hm/gme_is_projected_to_report_earnings_of_042_per/)

|

||||||

|

|

||||||

|

September you Say? No Dates Just Some History And News

|

||||||

|

|

||||||

|

[NSCC-005 Implemented September 11](https://www.reddit.com/r/Superstonk/comments/p5kr5z/nscc005_approval_accelerated_publication_tomorrow/?utm_medium=android_app&utm_source=share)

|

||||||

|

|

||||||

|

[Marge N Gets a New Phone in September](https://www.reddit.com/r/Superstonk/comments/p44h5o/dtcc_executive_director_warns_that_due_to_changes/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/9j3whxdkdwh71.png?width=666&format=png&auto=webp&s=12d63dc0b34d62d84c772de68fff4ebe721de097)

|

||||||

|

|

||||||

|

https://www.reddit.com/r/Superstonk/comments/p5ef5p/weve_been_through_ice_and_fire_apes_no_joke_i/

|

||||||

|

|

||||||

|

Memes and Fluff:

|

||||||

|

|

||||||

|

[](https://preview.redd.it/5d3i0d7fdwh71.jpg?width=640&format=pjpg&auto=webp&s=090fc6fa2c715c1332a8dcfa1dc8cf20d45614b1)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/gj1rc5utdwh71.png?width=500&format=png&auto=webp&s=366049a85568cb7c8d7acefa63098c29b95b3f77)

|

||||||

|

|

||||||

|

[u/snoofloofs2854](https://www.reddit.com/u/snoofloofs2854/)

|

||||||

|

|

||||||

|

AMA: You Asked, Mods Listened!

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p2ttdo/ama_announcement_robert_shapiro_lucy_komisar_18th/>

|

||||||

|

|

||||||

|

[EXCELLENT!](https://giphy.com/gifs/ifc-80s-bill-and-ted-excellet-l46CDHTqbmnGZyxKo)

|

||||||

|

|

||||||

|

We don't care, just be nice and let's make this community as Excellent as we can!

|

||||||

|

|

||||||

|

A few wrinkled-brained apes for quick post history access:

|

||||||

|

|

||||||

|

[u/DeepFuckingValue](https://www.reddit.com/u/DeepFuckingValue/) (dont need to explain)

|

||||||

|

|

||||||

|

[u/atobitt](https://www.reddit.com/u/atobitt/) (DD)

|

||||||

|

|

||||||

|

[u/Criand](https://www.reddit.com/u/Criand/) (DD)

|

||||||

|

|

||||||

|

[u/peruvian_bull](https://www.reddit.com/u/peruvian_bull/) (DD addict)

|

||||||

|

|

||||||

|

[u/Parsnip](https://www.reddit.com/u/Parsnip/) (German Market Guy | Diamantenhände)

|

||||||

|

|

||||||

|

[u/DR7KE](https://www.reddit.com/u/DR7KE/) (scales Treasury Balance Guy scales)

|

||||||

|

|

||||||

|

[u/pctracer](https://www.reddit.com/u/pctracer/) (Reverse Repo Market Updater)

|

||||||

|

|

||||||

|

[u/JTH1](https://www.reddit.com/u/JTH1/) (Floor Guy Stonkdate)

|

||||||

|

|

||||||

|

[u/mr_boost](https://www.reddit.com/u/mr_boost/) (Ape News Network | Sign Guy)

|

||||||

|

|

||||||

|

[u/gherkinit](https://www.reddit.com/u/gherkinit/) (Daily Technical Analysis)

|

||||||

|

|

||||||

|

[u/Dismal-Jellyfish](https://www.reddit.com/u/Dismal-Jellyfish/)

|

||||||

|

|

||||||

|

Thank you to the mod team!! Thank you to YOU ALL BEAUTIFUL APES!

|

||||||

|

|

||||||

|

Remember not to to give your password or log in information to anyone. If it seems suspicious don't do it! Phishing attacks have become more common across all platforms.

|

||||||

|

|

||||||

|

As always we are here from all different walks of life and all different countries. This doesn't matter as we are all apes in here, and apes are friends. We help each other, we care for each other. Ape don't fight ape, apes help other apes!

|

||||||

|

|

||||||

|

Remember the fundamentals of this company are great, so for the love of god if someone starts with trying to spread FUD, remind yourself of the fundamentals. BUY and HODL.

|

||||||

|

|

||||||

|

Okay that is all for now smell ya later!

|

||||||

@ -0,0 +1,110 @@

|

|||||||

|

The Daily Stonk Aug 18,2021

|

||||||

|

===========================

|

||||||

|

|

||||||

|

| Author | Source |

|

||||||

|

| :-------------: |:-------------:|

|

||||||

|

| [u/Blazlyn](https://www.reddit.com/user/Blazlyn/) | [Reddit](https://www.reddit.com/r/Superstonk/comments/p6oks5/the_daily_stonk_aug_182021/) |

|

||||||

|

|

||||||

|

---

|

||||||

|

|

||||||

|

[HODL 💎🙌](https://www.reddit.com/r/Superstonk/search?q=flair_name%3A%22HODL%20%F0%9F%92%8E%F0%9F%99%8C%22&restrict_sr=1)

|

||||||

|

|

||||||

|

#[Gooooooood Moooooorning Superstonk!](<https://youtu.be/AwSra5p8MDw>)

|

||||||

|

|

||||||

|

It is a wonderful day to be up and in the jungle!

|

||||||

|

|

||||||

|

Today's is a short one. Life is busy the start of this week. Please remember to keep tagging me in things!

|

||||||

|

|

||||||

|

#[Cramer Calls Kenny Daddy](<https://www.reddit.com/r/Superstonk/comments/p5veco/9_year_old_video_resurfaces_of_jim_cramer/>)

|

||||||

|

|

||||||

|

#[Reverse Repo is Standing There MENACINGLY at $1T!](<https://www.reddit.com/r/Superstonk/comments/p6868i/daily_reverse_repo_update_0817_1053454b/>)

|

||||||

|

|

||||||

|

Still just sitting there....

|

||||||

|

|

||||||

|

In the event my goldfish brain forget here is Reverse Repo explained in a way even I can understand.

|

||||||

|

|

||||||

|

#[Treasury is at $335B](<https://www.reddit.com/r/Superstonk/comments/p6bavd/daily_treasury_balance_for_0816_362b_27b/>)

|

||||||

|

|

||||||

|

Looks like mommy gave them some milk money! +27B

|

||||||

|

|

||||||

|

Tick tock on the way to $0 although this doesn't necessarily mean a [real balance of $0](<https://www.reddit.com/r/Superstonk/comments/p5sv1z/correction_the_us_treasury_is_not_running_out_of/?utm_medium=android_app&utm_source=share>) it does act as a reliable indicator. Especially if it doesn't last to Q4.

|

||||||

|

|

||||||

|

#[Route Through IEX](<https://youtu.be/SLNySV4OQfk>)

|

||||||

|

|

||||||

|

Seriously. Do it.

|

||||||

|

|

||||||

|

#[Algorithms are Cyclical](<https://www.reddit.com/r/Superstonk/comments/p601la/algorithmic_cycle_theory_looking_bullish_day8/?utm_medium=android_app&utm_source=share>)

|

||||||

|

|

||||||

|

"This daily tracker is testing the theory that algorithmic price manipulation is cyclical. The cycle length between the last two price rips could be an insight into the backend of market maker's algorithmic manipulation, as well as our current position in the cycle." [u/fleshfarm-leftover](https://www.reddit.com/u/fleshfarm-leftover/)

|

||||||

|

|

||||||

|

#[FTDs Potentially 15:1 Ratio](<https://www.reddit.com/r/Superstonk/comments/p65d2d/the_number_of_gme_ftds_may_be_fifteen_times_15x/?utm_medium=android_app&utm_source=share>)

|

||||||

|

|

||||||

|

Over 2 million GME shares failed to deliver through the DTCC on January 26, 2021. [u/Tribune-of-the-Plebs](https://www.reddit.com/u/Tribune-of-the-Plebs/)

|

||||||

|

|

||||||

|

#[MCAD = BULLISH](<https://www.reddit.com/r/Superstonk/comments/p5uduq/parabolicsar_flipped_back_to_bullish_more_stars/?utm_medium=android_app&utm_source=share>)

|

||||||

|

|

||||||

|

Lines, candles, dots and arrows OH BABY

|

||||||

|

|

||||||

|

#[Kenny Goes Back to the Islands](<https://www.reddit.com/r/Superstonk/comments/p666ug/kenny_boy_preparing_to_make_a_run_for_it_to/?utm_medium=android_app&utm_source=share>)

|

||||||

|

|

||||||

|

Tick tock Kenny boi and the turtle crew. Time is running short.

|

||||||

|

|

||||||

|

#[SEC Fatality Combo?](<https://www.reddit.com/r/Superstonk/comments/p6m360/sec_emergency_orders_under_section_12k_of_the/?utm_medium=android_app&utm_source=share>)

|

||||||

|

|

||||||

|

"SEC can issue an emergency order. First order aimed to stop all FTD's by reducing the cycle to three days, and to prevent continued short selling if you had outstanding FTD's. The second order straight up banned short selling. They then put out a series of highly directed questions to get feedback on how to best target those responsible for the abusive naked short selling." [u/go-do-that-thing](https://www.reddit.com/u/go-do-that-thing/)

|

||||||

|

|

||||||

|

.

|

||||||

|

|

||||||

|

#Memes and Fluff:

|

||||||

|

|

||||||

|

[Bloody opening](<https://www.reddit.com/r/Superstonk/comments/p644hn/wut_doing_wall_street/?utm_medium=android_app&utm_source=share>)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p61668/this_shit_is_getting_ridiculous/?utm_medium=android_app&utm_source=share>

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p63jei/the_dd_hasnt_changed_were_all_just_waiting/?utm_medium=android_app&utm_source=share>

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p65fn6/i_remember_playing_warlords_on_the_atari_2600/?utm_medium=android_app&utm_source=share>

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p65ap5/as_far_as_im_concerned_the_msm_saying_apes_are/?utm_medium=android_app&utm_source=share>

|

||||||

|

|

||||||

|

#AMA: You Asked, Mods Listened!

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p2ttdo/ama_announcement_robert_shapiro_lucy_komisar_18th/>

|

||||||

|

|

||||||

|

#EXCELLENT!

|

||||||

|

|

||||||

|

We don't care, just be nice and let's make this community as Excellent as we can!

|

||||||

|

|

||||||

|

A few wrinkled-brained apes for quick post history access:

|

||||||

|

|

||||||

|

[u/DeepFuckingValue](https://www.reddit.com/u/DeepFuckingValue/) (dont need to explain)

|

||||||

|

|

||||||

|

[u/atobitt](https://www.reddit.com/u/atobitt/) (DD)

|

||||||

|

|

||||||

|

[u/Criand](https://www.reddit.com/u/Criand/) (DD)

|

||||||

|

|

||||||

|

[u/peruvian_bull](https://www.reddit.com/u/peruvian_bull/) (DD addict)

|

||||||

|

|

||||||

|

[u/Parsnip](https://www.reddit.com/u/Parsnip/) (German Market Guy | Diamantenhände)

|

||||||

|

|

||||||

|

[u/DR7KE](https://www.reddit.com/u/DR7KE/) (scales Treasury Balance Guy scales)

|

||||||

|

|

||||||

|

[u/pctracer](https://www.reddit.com/u/pctracer/) (Reverse Repo Market Updater)

|

||||||

|

|

||||||

|

[u/JTH1](https://www.reddit.com/u/JTH1/) (Floor Guy Stonkdate)

|

||||||

|

|

||||||

|

[u/mr_boost](https://www.reddit.com/u/mr_boost/) (Ape News Network | Sign Guy)

|

||||||

|

|

||||||

|

[u/gherkinit](https://www.reddit.com/u/gherkinit/) (Daily Technical Analysis)

|

||||||

|

|

||||||

|

[u/Dismal-Jellyfish](https://www.reddit.com/u/Dismal-Jellyfish/)

|

||||||

|

|

||||||

|

Thank you to the mod team!! Thank you to YOU ALL BEAUTIFUL APES!

|

||||||

|

|

||||||

|

Remember not to to give your password or log in information to anyone. If it seems suspicious don't do it! Phishing attacks have become more common across all platforms.

|

||||||

|

|

||||||

|

As always we are here from all different walks of life and all different countries. This doesn't matter as we are all apes in here, and apes are friends. We help each other, we care for each other. Ape don't fight ape, apes help other apes!

|

||||||

|

|

||||||

|

Remember the fundamentals of this company are great, so for the love of god if someone starts with trying to spread FUD, remind yourself of the fundamentals. BUY and HODL.

|

||||||

|

|

||||||

|

Okay that is all for now smell ya later!

|

||||||

@ -0,0 +1,208 @@

|

|||||||

|

The Daily Stonk Aug 19 AND 20, 2021

|

||||||

|

===================================

|

||||||

|

|

||||||

|

| Author | Source |

|

||||||

|

| :-------------: |:-------------:|

|

||||||

|

| [u/Blazlyn](https://www.reddit.com/user/Blazlyn/) | [Reddit](https://www.reddit.com/r/Superstonk/comments/p82pk6/the_daily_stonk_aug_19_and_20_2021/) |

|

||||||

|

|

||||||

|

---

|

||||||

|

|

||||||

|

[HODL 💎🙌](https://www.reddit.com/r/Superstonk/search?q=flair_name%3A%22HODL%20%F0%9F%92%8E%F0%9F%99%8C%22&restrict_sr=1)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/lhw0ayosnhi71.png?width=1600&format=png&auto=webp&s=e54d152f8fe0f3a78dcfdbde88dd9fd6b0a6b863)

|

||||||

|

|

||||||

|

[Gooooooood Moooooorning Superstonk!](https://www.youtube.com/watch?v=AwSra5p8MDw)

|

||||||

|

|

||||||

|

It is a wonderful day to be up and in the jungle!

|

||||||

|

|

||||||

|

Remember the fundamentals that our parents told us BUY and HODL. Grab you coffee or drop trau. It is time for the last two day's recap! There was a little brouhaha with Mr. AutoMod and my post was "removed" and I wasn't able to re-post it.

|

||||||

|

|

||||||

|

[Flair Day Friday!](https://www.reddit.com/r/Superstonk/comments/p7ob4g/tomorrow_it_begins_i_will_see_you_guys_tomorrow/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/7xpd3gznphi71.jpg?width=960&format=pjpg&auto=webp&s=79cfa70a6981debb489ab3fdf12566fc0d8db961)

|

||||||

|

|

||||||

|

[u/johnnagethebrave](https://www.reddit.com/u/johnnagethebrave/)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/drawing/comments/1qlwym/a_drunken_monkey_riding_a_black_swan/>

|

||||||

|

|

||||||

|

[Reverse Repo took a decent leap yesterday!](https://www.reddit.com/r/Superstonk/comments/p7j7la/daily_reverse_repo_update_0819_1109938b/)

|

||||||

|

|

||||||

|

Still just sitting there....

|

||||||

|

|

||||||

|

In the event my goldfish brain forget here is [Reverse Repo explained](https://www.reddit.com/r/Superstonk/comments/owwk1p/the_rrp_number_is_incredible_but_what_does_it/h7iv86i/?context=3) in a way even I can understand.

|

||||||

|

|

||||||

|

[](https://preview.redd.it/eg9ky36znhi71.png?width=700&format=png&auto=webp&s=b4957bc933e67d196b204ca4562b9df5dac9f379)

|

||||||

|

|

||||||

|

And on Wednesday:

|

||||||

|

|

||||||

|

[](https://preview.redd.it/hclev352ohi71.jpg?width=960&format=pjpg&auto=webp&s=d06f3c6b5a2f2c5c83e24025cdb5f21482b2cb14)

|

||||||

|

|

||||||

|

[u/canispeaktoyourmangr](https://www.reddit.com/u/canispeaktoyourmangr/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/831rfxczrhi71.jpg?width=960&format=pjpg&auto=webp&s=501c821cfaaef90be1dbffd32ab1e66025a124f7)

|

||||||

|

|

||||||

|

[u/TheLeagueOfScience](https://www.reddit.com/u/TheLeagueOfScience/)

|

||||||

|

|

||||||

|

[Treasury is at $313B](https://www.reddit.com/r/Superstonk/comments/p7mfts/daily_treasury_balance_for_0818_313b_25b/?utm_medium=android_app&utm_source=share)

|

||||||

|

|

||||||

|

Down, down, down it goes! Gently down the drain!

|

||||||

|

|

||||||

|

[](https://preview.redd.it/e1uqv2pdohi71.png?width=960&format=png&auto=webp&s=7302bd6cb9e9d649070afe057cc8ff80c7e00922)

|

||||||

|

|

||||||

|

[Tick tock on the way to $0](https://www.reddit.com/r/Superstonk/comments/p5potn/treasury_balance_prediction_new_linear_bankruptcy/)

|

||||||

|

|

||||||

|

This doesn't necessarily mean a [real balance of $0](https://www.reddit.com/r/Superstonk/comments/p5sv1z/correction_the_us_treasury_is_not_running_out_of/?utm_medium=android_app&utm_source=share); it does act as a reliable indicator. Especially if it doesn't last to Q4.

|

||||||

|

|

||||||

|

[Low Volume of 1.19 Million](https://www.reddit.com/r/Superstonk/comments/p7msbt/i_cant_hear_you_closed_with_119_mil_volume_a_top/)

|

||||||

|

|

||||||

|

[u/edgar510](https://www.reddit.com/u/edgar510/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/4ucgmi1iqhi71.jpg?width=770&format=pjpg&auto=webp&s=bd5a6dc15d5e1cee84267957abf8b4fc1db56d6c)

|

||||||

|

|

||||||

|

[Route Through IEX](https://www.youtube.com/watch?v=SLNySV4OQfk)

|

||||||

|

|

||||||

|

Seriously. Do it.

|

||||||

|

|

||||||

|

[Rebuilding GameStop Brick By Brick](https://www.reddit.com/r/Superstonk/comments/p6usyi/to_be_fair_you_need_a_high_iq_to_understand_the/)

|

||||||

|

|

||||||

|

Looks like rebuilding a company takes time. It also takes vision and gusto. Good fundamentals, adaption to technology and leadership = BUY and HODL.

|

||||||

|

|

||||||

|

"Brick by brick, my fellow citizens, brick by brick." This quote is originally attributed to Emperor Hadrian, who allegedly said it while urging his people to re-build Rome after a horrific fire, encouraging them to do so in a methodical manner so that it may stand the test of time.

|

||||||

|

|

||||||

|

[Ryan Cohen's inspiration was Jeff Bezos. In the opposite vein to not be a dick.](https://www.reddit.com/r/Superstonk/comments/p7ldac/ryan_cohens_inspiration_was_from_jeff_bezos_being/)

|

||||||

|

|

||||||

|

[$14B Back To The Islands!](https://www.reddit.com/r/Superstonk/comments/p7l5bl/kenny_sent_another_14_billion_to_cayman_islands/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/dtiz0ku3qhi71.jpg?width=640&format=pjpg&auto=webp&s=9faa9b359184e4eb380aa5eb1fe550104961ea62)

|

||||||

|

|

||||||

|

[Offshore Shell Companies and Credit Swaps](https://www.reddit.com/r/Superstonk/comments/p7mj8o/usa_office_of_the_comptroller_of_currency_proves/)

|

||||||

|

|

||||||

|

Looks like we are in 2008 again friends. Only this time the bubble is larger and the risks are greater (for Kenny G and Stevie C).

|

||||||

|

|

||||||

|

[Billionaire Boy's Club](https://www.reddit.com/r/Superstonk/comments/p7nl7y/billionaire_boys_clib_episode_11_bbc_billionaire/)

|

||||||

|

|

||||||

|

BUY BORROW DIE

|

||||||

|

|

||||||

|

[A Load of DD To The SEC From An Ape](https://www.reddit.com/r/Superstonk/comments/p75onb/took_the_gloves_off_gave_the_sec_all_my_data/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/v7vgopnfohi71.png?width=600&format=png&auto=webp&s=047ff471c8ff64e3fc11f30f951b84fe6b558952)

|

||||||

|

|

||||||

|

[Two Airplanes?](https://www.reddit.com/r/Superstonk/comments/p77sa0/tldr_two_planes_are_being_used_why_the_fuck_under/)

|

||||||

|

|

||||||

|

Looks like he has two planes under two companies. Fly one one place then take the other from there. Completely normal activity there. [Or does he take a boat to work and then a car to see Steven Cohen?](https://www.reddit.com/r/Superstonk/comments/p778sn/kenny_in_long_island_wut_doing_ken_we_may_have/)

|

||||||

|

|

||||||

|

[George V Griffin](https://www.reddit.com/r/Superstonk/comments/p7ko38/entire_case_document_w_complete_verified/)

|

||||||

|

|

||||||

|

[The next Pump and Dump?](https://www.reddit.com/r/Superstonk/comments/p68mtv/adult_needed_clumsy_ape_found_something_but_has/)

|

||||||

|

|

||||||

|

If you wrinkle brains could look into this that would really be appreciated!

|

||||||

|

|

||||||

|

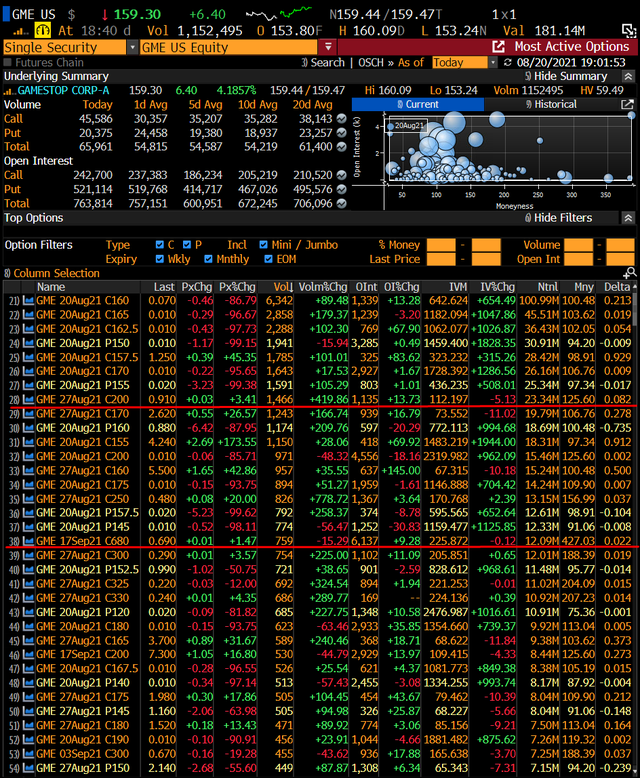

[400k Puts Due On Final Day Of MoonJam](https://www.reddit.com/r/Superstonk/comments/p72xx0/i_am_here_to_remind_you_about_the_400k_july_16/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/7u6uztpgohi71.jpg?width=960&format=pjpg&auto=webp&s=6ddeab9f67a483a97d5d049588b690c195ede60c)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/zyipf09wrhi71.png?width=640&format=png&auto=webp&s=5e589781e4f935655becca144a7392a7460f9dca)

|

||||||

|

|

||||||

|

[Point 72 and GME](https://www.reddit.com/r/Superstonk/comments/p6ywhg/connecting_point72_to_gme_by_op_ulpeak57_user/)

|

||||||

|

|

||||||

|

Some possible DD into links of Point 72 and GME. Point72 is using Grayscale/Coindesk to manipulate c r y p t o with the help of Cathie Woods of ARK to gain infinite leverage to continue to short GME and avoid margin call.

|

||||||

|

|

||||||

|

[Financial Hot Potato](https://www.reddit.com/r/Superstonk/comments/p73nx2/they_see_me_accountin_they_hating_a_look_into/)

|

||||||

|

|

||||||

|

Citadel sets it own terms for transactions between different broker dealer businesses they operate. They use reverse repurchase and repurchase agreement and use securities received to cover short position. Terms of those agreements between the affiliated parties might be of material difference. I haven't seen much attention given to this topic but the financial statements seem to point in that direction. Remember interns and any any employee reading this: [YOU CAN MAKE MILLIONS TO REPORT THINGS TO THE SEC.](https://www.sec.gov/news/press-release/2021-128)

|

||||||

|

|

||||||

|

[When in Doubt ZOOM OUT](https://www.reddit.com/r/Superstonk/comments/p7xy7z/that_1_year_chart_tells_a_story_of_success_be/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/p1q8b8jqrhi71.jpg?width=700&format=pjpg&auto=webp&s=eecc0caf3f6a75bdd32f498d40c6457e21ce07e1)

|

||||||

|

|

||||||

|

[Vlad's Infamous Call](https://www.reddit.com/r/Superstonk/comments/p7elma/vlad_tenevs_call_with_the_nscc_shutting_off_the/)

|

||||||

|

|

||||||

|

Looks like Musk was on the line too. We are in a simulation.

|

||||||

|

|

||||||

|

Memes and Fluff:

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p6svg6/thats_it_i_quit_more_money_for_gme_and_longer/>

|

||||||

|

|

||||||

|

[u/Chief-Irish](https://www.reddit.com/u/Chief-Irish/) Keep it up! We are all rooting for you!!!! Keep us updated!

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p7nvk1/ape_news_network_81921_tomorrow_is_hype_day_again/>

|

||||||

|

|

||||||

|

[u/mr_boost](https://www.reddit.com/u/mr_boost/)

|

||||||

|

|

||||||

|

[](https://preview.redd.it/jinmv9iiohi71.png?width=825&format=png&auto=webp&s=af23c190d4e56722d21282e2371f22d9e794466a)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p6u7hm/how_my_personal_journey_of_gme_has_gone_over_the/>

|

||||||

|

|

||||||

|

[](https://preview.redd.it/1gmzuu3kohi71.jpg?width=700&format=pjpg&auto=webp&s=f5f30552bcdb88df77537841e8cbd7eaf21a63f0)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p6s9lo/reminder_this_is_the_mindset_of_all_true_apes/?utm_medium=android_app&utm_source=share>

|

||||||

|

|

||||||

|

[](https://preview.redd.it/1hagx1imohi71.jpg?width=556&format=pjpg&auto=webp&s=e6cedcc27ccad9317cfe778d85a7ee8d82712153)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p6uaga/trading_is_hard_aint_it/?utm_medium=android_app&utm_source=share>

|

||||||

|

|

||||||

|

[](https://preview.redd.it/wvh9ou5nohi71.jpg?width=960&format=pjpg&auto=webp&s=36c355d028a5d12d36c3e8a72665c598952d5f0a)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p7rsa6/october_1st_is_the_squeeze_then/>

|

||||||

|

|

||||||

|

[](https://preview.redd.it/hdvq2k0eqhi71.jpg?width=960&format=pjpg&auto=webp&s=3a1a42c5251cea5e2181aa36fee288d114c52abe)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p6otiv/remember_no_dates/?utm_medium=android_app&utm_source=share>

|

||||||

|

|

||||||

|

[](https://preview.redd.it/5mnjdqioohi71.jpg?width=960&format=pjpg&auto=webp&s=3eacb02e2031c382c0150aebd43675d39305ef1e)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p7wvnh/holy_sht_what_simulation_is_this_2_of_my_videos/>

|

||||||

|

|

||||||

|

[u/gandofu8](https://www.reddit.com/u/gandofu8/) you scamp!

|

||||||

|

|

||||||

|

[RC Twitter 21 Days Later](https://twitter.com/ryancohen/status/1428518642937892868)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p7suws/those_damn_shorts/>

|

||||||

|

|

||||||

|

[](https://preview.redd.it/nkte1qf5shi71.jpg?width=826&format=pjpg&auto=webp&s=aee0cfc0532ef07b90d4fa3d8f2e5db163685af7)

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p7vblb/am_i_doing_this_right/>

|

||||||

|

|

||||||

|

[](https://preview.redd.it/zhsretunqhi71.jpg?width=960&format=pjpg&auto=webp&s=d642c6bd49a59b678e038862d85a327ac71b570c)

|

||||||

|

|

||||||

|

AMA: You Asked, Mods Listened! References and Links!

|

||||||

|

|

||||||

|

<https://www.reddit.com/r/Superstonk/comments/p74oc9/ama_navigation_links_dr_robert_j_shapiro_lucy/>

|

||||||

|

|

||||||

|

[EXCELLENT!](https://giphy.com/gifs/ifc-80s-bill-and-ted-excellet-l46CDHTqbmnGZyxKo)

|

||||||

|

|

||||||

|

We don't care, just be nice and let's make this community as Excellent as we can!

|

||||||

|

|

||||||

|

A few wrinkled-brained apes for quick post history access:

|

||||||

|

|

||||||

|

[u/mr_boost](https://www.reddit.com/u/mr_boost/) (Ape News Network | Sign Guy)

|

||||||

|

|

||||||

|

[u/Parsnip](https://www.reddit.com/u/Parsnip/) (German Market Guy | Diamantenhände)

|

||||||

|

|

||||||

|

[u/gherkinit](https://www.reddit.com/u/gherkinit/) (Daily Technical Analysis)

|

||||||

|

|

||||||

|

[u/DR7KE](https://www.reddit.com/u/DR7KE/) (scales Treasury Balance Guy scales)

|

||||||

|

|

||||||

|

[u/pctracer](https://www.reddit.com/u/pctracer/) (Reverse Repo Market Updater)

|

||||||

|

|

||||||

|

[u/JTH1](https://www.reddit.com/u/JTH1/) (Floor Guy Stonkdate)

|

||||||

|

|

||||||

|

[u/DeepFuckingValue](https://www.reddit.com/u/DeepFuckingValue/) (dont need to explain)

|

||||||

|

|

||||||

|

[u/atobitt](https://www.reddit.com/u/atobitt/) (DD)

|

||||||

|

|

||||||

|

[u/Criand](https://www.reddit.com/u/Criand/) (DD)

|

||||||

|

|

||||||

|

[u/Dismal-Jellyfish](https://www.reddit.com/u/Dismal-Jellyfish/)

|

||||||

|

|

||||||

|

[u/peruvian_bull](https://www.reddit.com/u/peruvian_bull/) (DD addict)

|

||||||

|

|

||||||

|

Thank you to the mod team!! Thank you to YOU ALL BEAUTIFUL APES!

|

||||||

|

|

||||||

|

Remember not to to give your password or log in information to anyone. If it seems suspicious don't do it! Phishing attacks have become more common across all platforms.

|

||||||

|

|

||||||

|

As always we are here from all different walks of life and all different countries. This doesn't matter as we are all apes in here, and apes are friends. We help each other, we care for each other. Ape don't fight ape, apes help other apes!

|

||||||

|

|

||||||

|

Remember the fundamentals of this company are great, so for the love of god if someone starts with trying to spread FUD, remind yourself of the fundamentals. BUY and HODL.

|

||||||

|

|

||||||

|

Okay that is all for now smell ya later!

|

||||||

@ -0,0 +1,102 @@

|

|||||||

|

Jerkin' it with Gherkinit S6 E9 Live Charting and TA for 8/16/2021

|

||||||

|

==================================================================

|

||||||

|

|

||||||

|

| Author | Source |

|

||||||

|

| :-------------: |:-------------:|

|

||||||

|

| [u/gherkinit](https://www.reddit.com/user/gherkinit/) | [Reddit](https://www.reddit.com/r/Superstonk/comments/p5fabc/jerkin_it_with_gherkinit_s6_e9_live_charting_and/) |

|

||||||

|

|

||||||

|

---

|

||||||

|

|

||||||

|

[Discussion 🦍](https://www.reddit.com/r/Superstonk/search?q=flair_name%3A%22Discussion%20%F0%9F%A6%8D%22&restrict_sr=1)

|

||||||

|

|

||||||

|

Good Morning Apes!

|

||||||

|

|

||||||

|

It's finally here!

|

||||||

|

|

||||||

|

Not MOASS but season 6 episode 9 of live charting with you favorite disgruntled neighborhood pickle!

|

||||||

|

|

||||||

|

Let that sink in that's 81 of these since I started counting.

|

||||||

|

|

||||||

|

Thank you all for being along for the ride!

|

||||||

|

|

||||||

|

I don't know about you guys but I think it's time for another MOASS Monday: Part Deux...

|

||||||

|

|

||||||

|

[](https://preview.redd.it/hsdtf7dasph71.png?width=900&format=png&auto=webp&s=ade3e7d070a79f83cc7b8d91d2036cd7dfd25af1)

|

||||||

|

|

||||||

|

If you guys haven't had a chance to [Check out this weeks forward looking TA](https://www.reddit.com/r/Superstonk/comments/p53sln/jerkin_it_with_gherkinit_forward_looking_ta_for/)

|

||||||

|

|

||||||

|

Join us in the Daily Livestream <https://www.youtube.com/c/PickleFinancial>

|

||||||

|

|

||||||

|

Or listen along with our live audio feed on [Discord](https://discord.gg/HbqnUVsSrH)

|

||||||

|

|

||||||

|

(save these links in case reddit goes down)

|

||||||

|

|

||||||

|

*(this post will read from top to bottom)*

|

||||||

|

|

||||||

|

(*feel free to ask me questions below, but if you can google it yourself please use common sense)*

|

||||||

|

|

||||||

|

Historical Resistance/Support:

|

||||||

|

|

||||||

|

116.5, 125.5, 132.5, 141, 145, 147.5, 150, 152.5, 157 (previous ATM offering), 158.5, 162.5, 163, 165.5, 172.5, 174, 176.5, 180.5, 182.5, 185, 187.5, 190, 192.5, 195, 196.5, 197.5, 200, 209, 211.5, 214.5, 218, 225.20 (new ATM offering) 226, 232.5, 235, 242.5, 250, 255, 262.5, 275, 280, 285, 300, 302.50, 310, 317.50, 325, 332.5, 340, 350, 400, 483, moon base...

|

||||||

|

|

||||||

|

After Market

|

||||||

|

|

||||||

|

Had a nice up then sideways day that $10 dollar move today happened on 500k volume, looks good for the idea that bid/ask spread is gonna catapult this thing into the stratosphere on low volume...We also had a nice volume spike right at close. I'll be paying attention to performance in AH. Thank you all for tuning in see you tomorrow.

|

||||||

|

|

||||||

|

- Gherkinit

|

||||||

|

|

||||||

|

<https://preview.redd.it/r9xvbdas0sh71.png?width=681&format=png&auto=webp&s=6df7ab8d8751054b988c44d7f097a43a5e4f87fb>

|

||||||

|

|

||||||

|

Edit 6 2:02

|

||||||

|

|

||||||

|

Found our way back above VWAP we are definitely well positioned on the current trend for another test of 170

|

||||||

|

|

||||||

|

<https://preview.redd.it/j9aqxau4frh71.png?width=1638&format=png&auto=webp&s=417b517b018ff4ac00878b39029d1c73024c39ad>

|

||||||

|

|

||||||

|

Edit 5 11:55

|

||||||

|

|

||||||

|

Looks like some midday chop as the volume dries up, hopefully we can stay above VWAP

|

||||||

|

|

||||||

|

<https://preview.redd.it/1y0umwlesqh71.png?width=1643&format=png&auto=webp&s=83240816d5cba76b8549593f1909e2191db21c1b>

|

||||||

|

|

||||||

|

Edit 4 11:10

|

||||||

|

|

||||||

|

Failed that first test of 170 but have a decent bounce on VWAP moving in for another test. OI on call side is pretty stacked at 170 so the beginning of the ramp we would want to see 175 for that to start to be hedged

|

||||||

|

|

||||||

|

<https://preview.redd.it/vunrs99jkqh71.png?width=1650&format=png&auto=webp&s=5ebe685a6a89ecad4256665d9e67df097b9ca7de>

|

||||||

|

|

||||||

|

Edit 3 10:39

|

||||||

|

|

||||||

|

GME feelin' cute

|

||||||

|

|

||||||

|

<https://preview.redd.it/syogc7vueqh71.png?width=1639&format=png&auto=webp&s=654273756707ec2429d38fe4cd46f3db094fbe2e>

|

||||||

|

|

||||||

|

Edit 2 10:17

|